How To Create Checking Account Quicken For Mac Youtube

Oct 31, 2018 - Adding Accounts To Quicken. Product Version. If you prefer to add accounts that you manually enter transactions into (not connected to a bank), you can. Setting up an Account Shows 'Ignore' and Cannot Add Account. Customer Reviews Community Facebook YouTube Twitter. How do I remove an account from Quicken - Answered by a verified Tech Support Rep. I just put quicken on my mac (just transferred years of quicken info from my PC). I had to change passwords on my bank account and now the Quicken has divided my checking account into two. The regular account and a 'new' checking account' How do I.

This specific tutorial is a single movie from chapter two of the Quicken 2009 for Windows Essential Training course presented by lynda.com author Tom Negrino. Watch more at The complete course has a total duration of 3 hours and 32 minutes. Quicken 2009 for Windows Essential Training table of contents: Introduction 1.  Exploring the Quicken Workspace 2. Creating Financial Accounts 3.

Exploring the Quicken Workspace 2. Creating Financial Accounts 3.

Apple assumes no responsibility with regard to the selection, performance, or use of third-party websites or products. Se mo leannan mac for baile youtube 2017. Risks are inherent in the use of the Internet. Apple makes no representations regarding third-party website accuracy or reliability. Information about products not manufactured by Apple, or independent websites not controlled or tested by Apple, is provided without recommendation or endorsement. For additional information.

Setting Up Categories 4. Using the Account Registers 5. Entering Data 6. Writing and Printing Checks Using Quicken 7. Connecting Quicken to Online Banking and Bill Payment 8. Balancing Your Accounts 9.

Using the Calendar and Scheduling Options 10. Working with Loans 11. Setting Up Investment Accounts 12.

Managing Investments 13. Creating Reports and Graphs 14. Using Quicken at Tax Time 15. Using Quicken for Business Accounts (Quicken Home & Business) Conclusion.

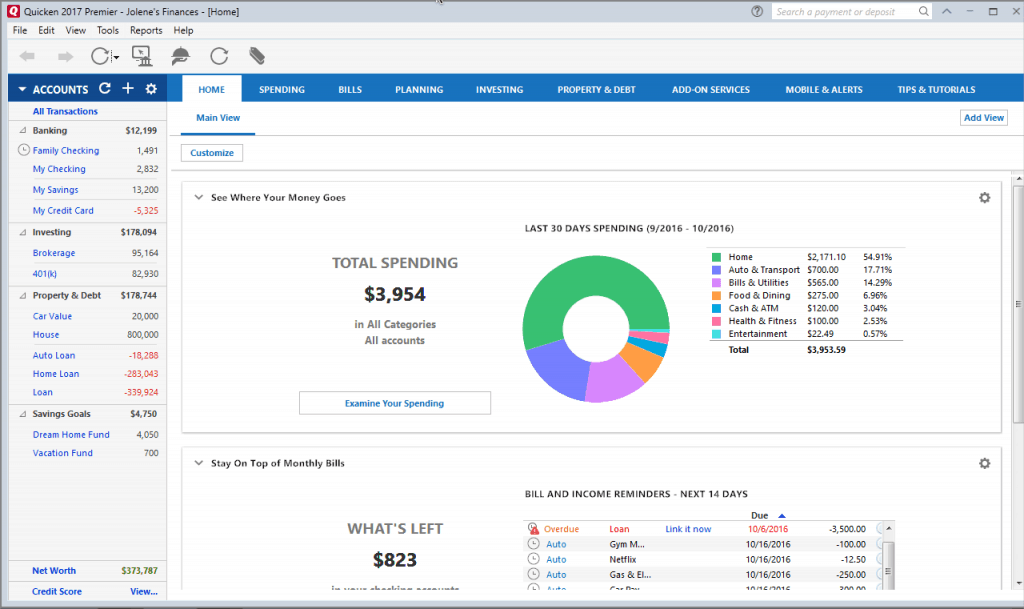

After years of evolution, Intuit's Quicken provides all the finance-management features most people will ever need. With Quicken, you can track checking-account and credit-card transactions, pay bills, manage your investment portfolio, and even plan for taxes and retirement. You can also download your bank and investment statements directly into Quicken and pay bills with electronic checks. This program already does so much that the pace of development has slowed, and Quicken 2003 sports only a small number of new features, such as interface improvements and some capabilities for advanced investors. With few exceptions, these enhancements add convenience rather than necessary functions, so the frugal Quicken user should evaluate Quicken 2003 carefully before paying to upgrade. This Year's Model One of the most useful new features in Quicken 2003 is scheduled automatic updating of information about investments and accounts you've set up for online access (including online banking). You can set Quicken to download data from such accounts at specified days and times (see 'Information on Cue').

So if you're organized enough to work with your finances at the same time each week, Quicken can have all the information you need ready for you before you sit down at your Mac. Intuit has also consolidated several functions--such as One Step Update, PIN Vault, and your online-transaction history--into one convenient Online Account Updates window. Support for Mac OS X is improved in Quicken 2003, and the program looks much more like a native Aqua application, with more-attractive icons and controls, though there's room for improvement. For example, although you can now assign Tax Links, which let you associate Quicken transaction categories with specific lines on a federal tax form, the scrollable window for selecting the tax lines is only six lines high and can't be resized; scrolling through the hundreds of choices is unnecessarily difficult. Quicken 2003 brings several improvements in the area of complex investment transactions. Quicken can now handle short selling and margin interest, and (perhaps in a reaction to a turbulent market) it can now merge two securities to account for corporate acquisitions. Best of all, Quicken can now track and manage cash in investment-portfolio accounts, so if you have a money-market checking account linked to your investment portfolio, you no longer have to manage the accounts in separate registers.